Last week the US Dollar retraced from the strength we had seen over the last few weeks as the Presidential Election at last came into focus.

We do not see the Dollar dominance easing in the longer term, but this was a pause as the markets wait for once again an election on a knife edge.

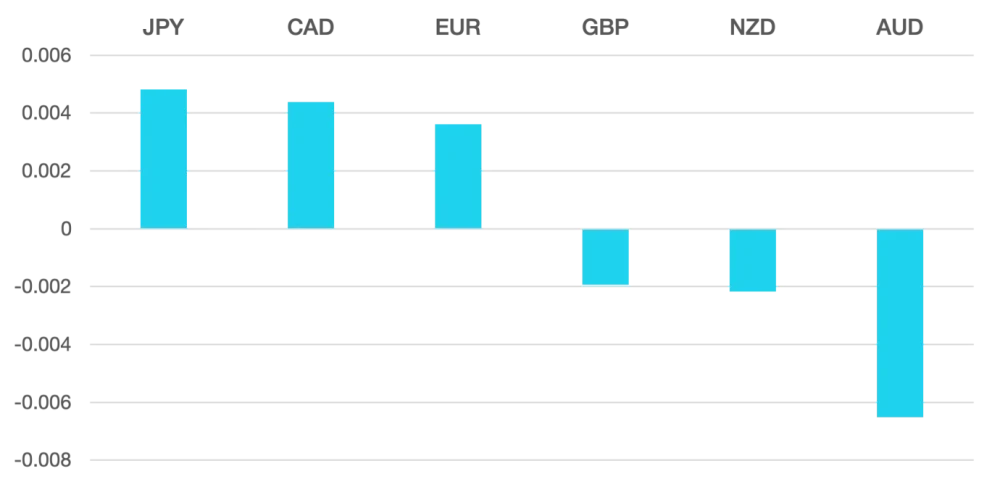

While the Dollar had its pause it gave the opportunity to others for once. The Euro stepped up and moved higher as more robust data which seems to have all but put the brakes on further aggressive rate cuts from the ECB.

On the flip side the Aussie ended the week on the back foot. Disinflation seems to have forced the hand of the RBA into 2025 to start making rate cuts.

Oil continued its recent move lower as the Middle East conflict remained quiet. Last week the WTI fell 3.3% to close at $69.29.

The week ahead is just the Presidential Election. Markets are braced for one once again a very close result and we expect some volatility around the announcement.

Data wise we have Interest rates from FOMC and the BoE.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Pre-Election Jitters first appeared on trademakers.

The post Pre-Election Jitters first appeared on JP Fund Services.

The post Pre-Election Jitters appeared first on JP Fund Services.